Maricopa County Real Estate Tax Lookup

Maricopa County Assessor's Office

Services and Products Veteran Personal Exemptions Information for Veteran’s 100% Service-Connected Disability Customer Portal Create an online account to file forms, search properties, file an appeal, and much more online. e-Notices The Maricopa County Assessor's Office now offers electronic notices, eNotices, for your Notice of Valuation.

https://www.mcassessor.maricopa.gov/

Maricopa County Assessor's Office

Services and Products Veteran Personal Exemptions Information for Veteran’s 100% Service-Connected Disability Customer Portal Create an online account to file forms, search properties, file an appeal, and much more online. e-Notices The Maricopa County Assessor's Office now offers electronic notices, eNotices, for your Notice of Valuation.

https://www.mcassessor.maricopa.gov/

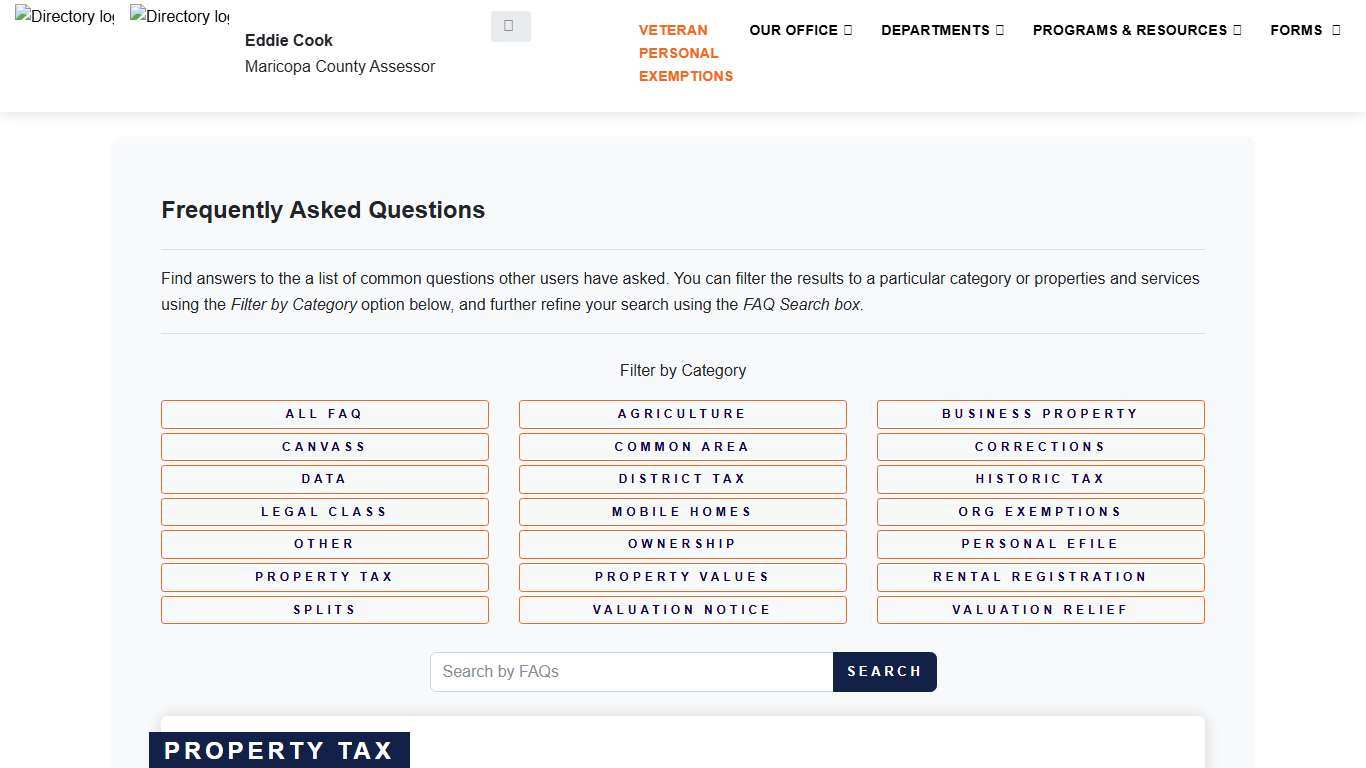

Maricopa County Assessor's Office

Arizona Revised Statutes defines Full Cash Value (FCV) as being synonymous with market value. For assessment purposes, Full Cash Value approximates market value except for possible conditions unique to mass appraisal. This value is for the tax year shown at the top of your valuation notice page.

https://www.mcassessor.maricopa.gov/faq/property_tax/

Maricopa County Assessor's Office

Arizona Revised Statutes defines Full Cash Value (FCV) as being synonymous with market value. For assessment purposes, Full Cash Value approximates market value except for possible conditions unique to mass appraisal. This value is for the tax year shown at the top of your valuation notice page.

https://www.mcassessor.maricopa.gov/faq/property_tax/

Recorded Document Search

ESTATE TAX WAIVER, EXECUTION, EXTENSION OF MORTGAGE, FEDERAL TAX LIEN, FINAL ... 2026. SEARCH. CLEAR. Internet Map Locator. Please enter a Recorder's BOOK and ...

https://recorder.maricopa.gov/recording/document-search.htmlTax Rate Table | Arizona Department of Revenue

Tax Rate Table Archive (PDF) · TPT Rate Table - January 2026 · TPT Rate Table - December 2025 · TPT Rate Table - November 2025 · TPT Rate Table - October 2025 · TPT ...

https://azdor.gov/business/transaction-privilege-tax/tax-rate-tableHow Do I - Maricopa County Assessor's Office

How Do I ... Using the list of choices below you can find answers to the most commonly asked questions: - How do I print all valuation years? - How do I change my mailing address? - How do I pay my taxes?

https://www.mcassessor.maricopa.gov/home/help/

How Do I - Maricopa County Assessor's Office

How Do I ... Using the list of choices below you can find answers to the most commonly asked questions: - How do I print all valuation years? - How do I change my mailing address? - How do I pay my taxes?

https://www.mcassessor.maricopa.gov/home/help/

Educational Videos

These short, animated videos help explain some of what we do. Check them out below! 2026 Notice of Value.

https://www.mcassessor.maricopa.gov/home/educational_videosProperty Tax - City of Mesa

Related Resources. Maricopa County Assessor · Maricopa County Treasurer. Share. Facebook · X · Email ... © 2026 City of Mesa | Powered by Granicus. Ready. Close ×

https://www.mesaaz.gov/Resident-Resources/Property-TaxeNotices - Maricopa County Assessor's Office

The Maricopa County Assessor's Office offers electronic notices, eNotices, for your Notice of Valuation. This service is easy to use, convenient, provides archives, and saves the County and its taxpayers money by reducing printing and postage costs! It is completely optional; you will only receive eNotices if you request the service.

https://www.mcassessor.maricopa.gov/home/enotice/

eNotices - Maricopa County Assessor's Office

The Maricopa County Assessor's Office offers electronic notices, eNotices, for your Notice of Valuation. This service is easy to use, convenient, provides archives, and saves the County and its taxpayers money by reducing printing and postage costs! It is completely optional; you will only receive eNotices if you request the service.

https://www.mcassessor.maricopa.gov/home/enotice/

Property Tax | Surprise, AZ - Official Website

Property Tax Primary property taxes are determined by your property’s assessed value, not the market value. Surprise has a current primary property tax rate of $0.5693 per $100 of assessed limited property valuation. The voter-approved GO Bonds created a secondary property tax that will be used to fund capital improvement projects.

https://surpriseaz.gov/1395/Property-Tax

Property Tax | Surprise, AZ - Official Website

Property Tax Primary property taxes are determined by your property’s assessed value, not the market value. Surprise has a current primary property tax rate of $0.5693 per $100 of assessed limited property valuation. The voter-approved GO Bonds created a secondary property tax that will be used to fund capital improvement projects.

https://surpriseaz.gov/1395/Property-Tax

Property Tax | Surprise, AZ - Official Website

Property Tax Primary property taxes are determined by your property’s assessed value, not the market value. Surprise has a current primary property tax rate of $0.5693 per $100 of assessed limited property valuation. The voter-approved GO Bonds created a secondary property tax that will be used to fund capital improvement projects.

https://surpriseaz.gov/1395/Property-Tax

Property Tax | Surprise, AZ - Official Website

Property Tax Primary property taxes are determined by your property’s assessed value, not the market value. Surprise has a current primary property tax rate of $0.5693 per $100 of assessed limited property valuation. The voter-approved GO Bonds created a secondary property tax that will be used to fund capital improvement projects.

https://surpriseaz.gov/1395/Property-Tax

NETR Online • Maricopa • Maricopa Public Records, Search Maricopa Records, Maricopa Property Tax, Arizona Property Search, Arizona Assessor

Select: Maricopa County Public Records The Grand Canyon State Maricopa Assessor (602) 506-3406 Maricopa Treasurer (602) 506-8511 Maricopa Recorder (602) 506-3535 Maricopa NETR Mapping and GIS Help us keep this directory a great place for public records information. Submit New Link Products available in the Property Data Store Comparable Properties Reports...

https://publicrecords.netronline.com/state/AZ/county/maricopa

NETR Online • Maricopa • Maricopa Public Records, Search Maricopa Records, Maricopa Property Tax, Arizona Property Search, Arizona Assessor

Select: Maricopa County Public Records The Grand Canyon State Maricopa Assessor (602) 506-3406 Maricopa Treasurer (602) 506-8511 Maricopa Recorder (602) 506-3535 Maricopa NETR Mapping and GIS Help us keep this directory a great place for public records information. Submit New Link Products available in the Property Data Store Comparable Properties Reports...

https://publicrecords.netronline.com/state/AZ/county/maricopa

Property Taxes by State & County: Median Property Tax Bills

Property taxes are the primary tool for financing local governments and generate a significant share of state and local revenues. In fiscal year 2020, property taxes comprised 32.2 percent of total state and local taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities.

https://taxfoundation.org/data/all/state/property-taxes-by-state-county-2023/

Property Taxes by State & County: Median Property Tax Bills

Property taxes are the primary tool for financing local governments and generate a significant share of state and local revenues. In fiscal year 2020, property taxes comprised 32.2 percent of total state and local taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities.

https://taxfoundation.org/data/all/state/property-taxes-by-state-county-2023/

2026 Maricopa, Arizona Sales Tax Calculator & Rate – Avalara

*Rates are rounded to the nearest hundredth. Due to varying local sales tax rates, we strongly recommend our lookup and calculator tools on this page for the most accurate rates. Maricopa sales tax details The minimum combined 2026 sales tax rate for Maricopa, Arizona is 9.2%.

https://www.avalara.com/taxrates/en/state-rates/arizona/cities/maricopa.html

2026 Maricopa, Arizona Sales Tax Calculator & Rate – Avalara

*Rates are rounded to the nearest hundredth. Due to varying local sales tax rates, we strongly recommend our lookup and calculator tools on this page for the most accurate rates. Maricopa sales tax details The minimum combined 2026 sales tax rate for Maricopa, Arizona is 9.2%.

https://www.avalara.com/taxrates/en/state-rates/arizona/cities/maricopa.html

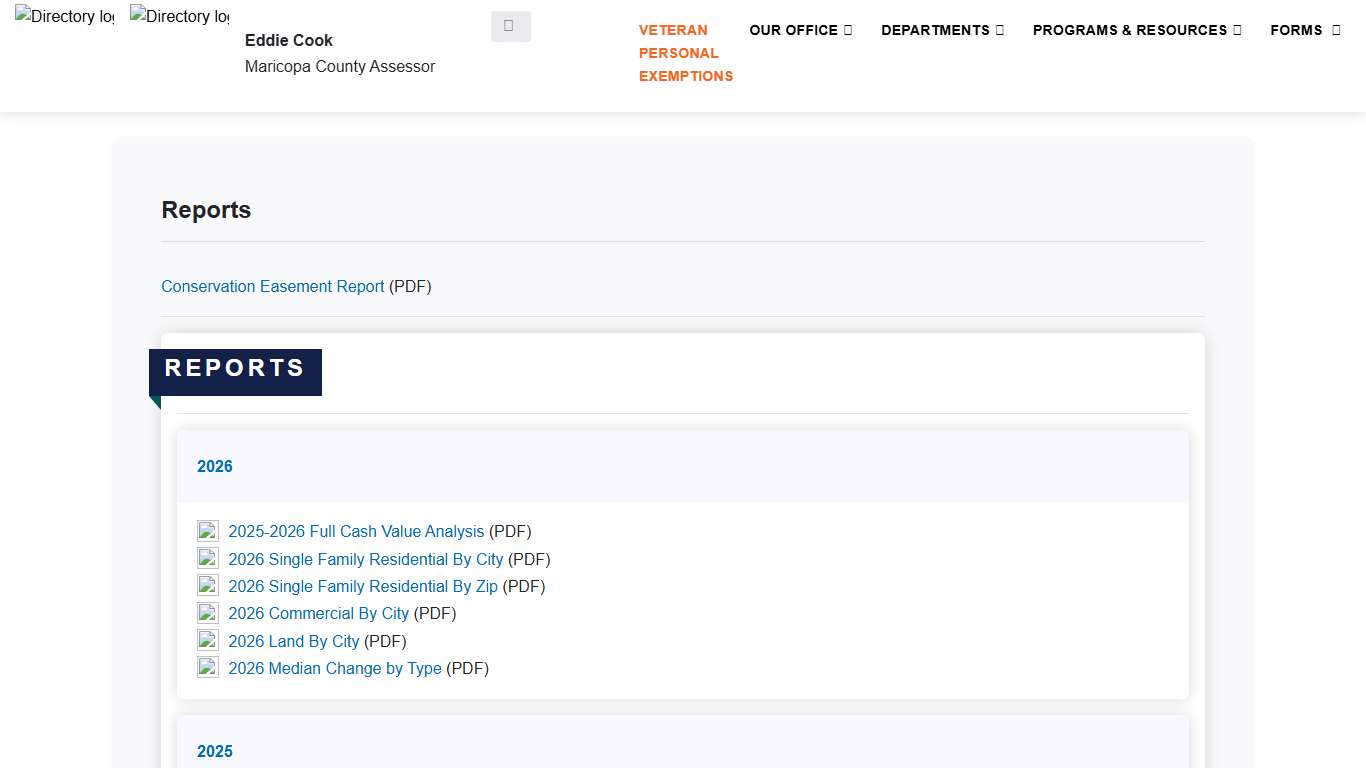

Reports Home - Maricopa County Assessor's Office

Reports Conservation Easement Report (PDF) Reports 2025 Abstract FCV for Bond Purposes (PDF) 2025 August State Abstract (XLSX) 2025 February State Abstract (XLSX) 2025 City Levy Limit Summary (PDF) 2025 City Summary (PDF) 2025 Fire District Levy Summary (PDF) 2025 Fire District Summary (PDF) 2025 School Summary (PDF) 2024-2025 Full Cash Value Analysis (PDF) 2025 Median Values by Property Type (PDF) 2025 Single Family Residential By City (PDF) ...

https://www.mcassessor.maricopa.gov/page/reports/

Reports Home - Maricopa County Assessor's Office

Reports Conservation Easement Report (PDF) Reports 2025 Abstract FCV for Bond Purposes (PDF) 2025 August State Abstract (XLSX) 2025 February State Abstract (XLSX) 2025 City Levy Limit Summary (PDF) 2025 City Summary (PDF) 2025 Fire District Levy Summary (PDF) 2025 Fire District Summary (PDF) 2025 School Summary (PDF) 2024-2025 Full Cash Value Analysis (PDF) 2025 Median Values by Property Type (PDF) 2025 Single Family Residential By City (PDF) ...

https://www.mcassessor.maricopa.gov/page/reports/

When Are Property Taxes Due in Arizona? - JVM Lending

Understanding the intricacies of property taxes is crucial for homeowners, and Arizona has its unique set of rules and schedules. In Arizona, property taxes are due in two installments. The 1st installment is due on October 1st and the 2nd installment is due on March 1st.

https://www.jvmlending.com/blog/when-are-property-taxes-due-in-arizona/

When Are Property Taxes Due in Arizona? - JVM Lending

Understanding the intricacies of property taxes is crucial for homeowners, and Arizona has its unique set of rules and schedules. In Arizona, property taxes are due in two installments. The 1st installment is due on October 1st and the 2nd installment is due on March 1st.

https://www.jvmlending.com/blog/when-are-property-taxes-due-in-arizona/

Home Page - eNoticesOnline.com - eNoticesOnline.com

Welcome to eNoticesOnline.com gives you so many ways to save while reducing your paper footprint and going green. It's quick, it's easy, and it's FREE to go paperless on your next notice. - Save Steps - You simply get an email any time a new notice becomes available on your account.

https://enoticesonline.com/

Home Page - eNoticesOnline.com - eNoticesOnline.com

Welcome to eNoticesOnline.com gives you so many ways to save while reducing your paper footprint and going green. It's quick, it's easy, and it's FREE to go paperless on your next notice. - Save Steps - You simply get an email any time a new notice becomes available on your account.

https://enoticesonline.com/

Maricopa County Property Tax 💰 | Maricopa County Property Tax Rate by City & More

Last Updated on: 3rd April 2025, 03:53 am If you’re planning to purchase a home in Maricopa County or are considering a move to the Phoenix metro area, understanding property taxes is an essential part of the process. Property taxes help fund local services, schools, and infrastructure, but how exactly do they work in Arizona?

https://mentorsmoving.com/blog/maricopa-county-property-tax-guide/

Maricopa County Property Tax 💰 | Maricopa County Property Tax Rate by City & More

Last Updated on: 3rd April 2025, 03:53 am If you’re planning to purchase a home in Maricopa County or are considering a move to the Phoenix metro area, understanding property taxes is an essential part of the process. Property taxes help fund local services, schools, and infrastructure, but how exactly do they work in Arizona?

https://mentorsmoving.com/blog/maricopa-county-property-tax-guide/

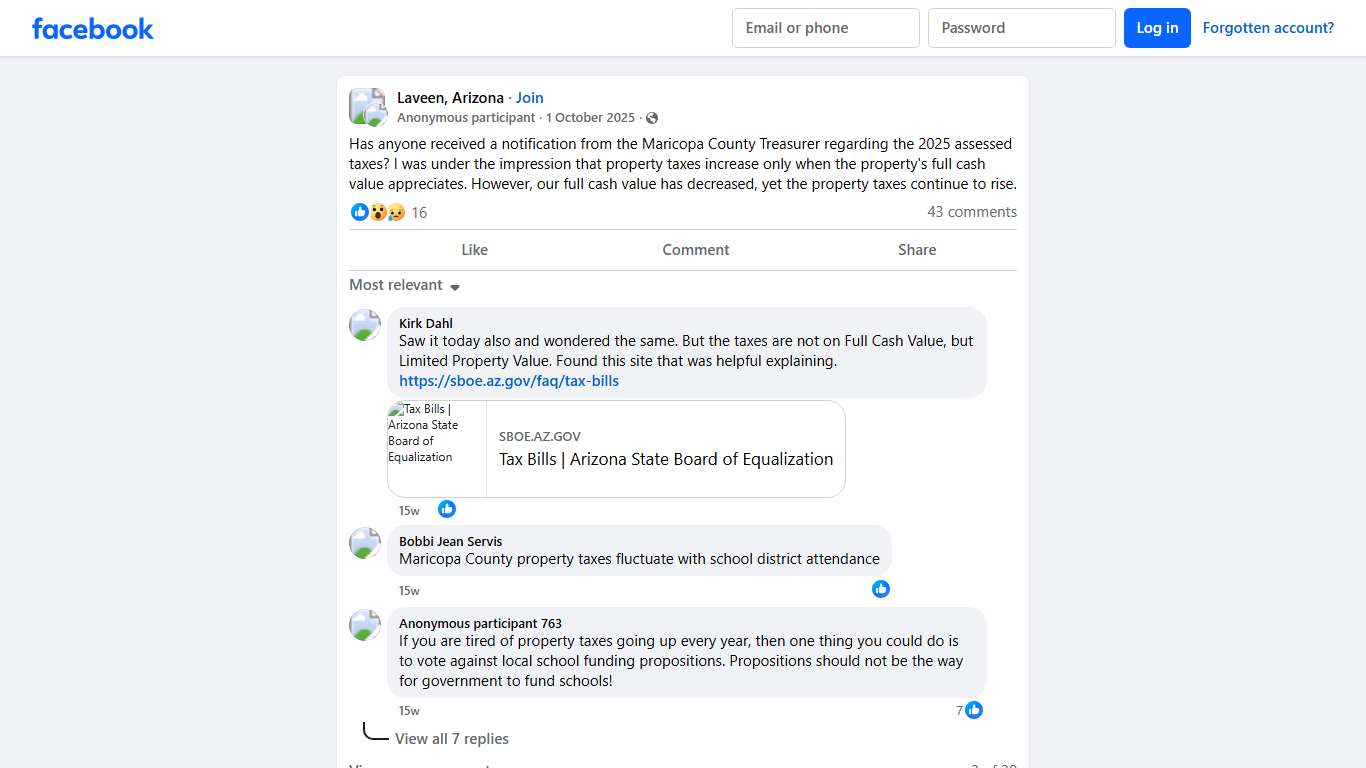

Laveen, Arizona | Has anyone received a notification from the Maricopa County Treasurer regarding the 2025 assessed taxes | Facebook

Has anyone received a notification from the Maricopa County Treasurer regarding the 2025 assessed taxes? I was under the impression that property taxes increase only when the property's full cash value appreciates. However, our full cash value has decreased, yet the property taxes continue to rise.

https://www.facebook.com/groups/LaveenCommunity/posts/10161491904106831/

Laveen, Arizona | Has anyone received a notification from the Maricopa County Treasurer regarding the 2025 assessed taxes | Facebook

Has anyone received a notification from the Maricopa County Treasurer regarding the 2025 assessed taxes? I was under the impression that property taxes increase only when the property's full cash value appreciates. However, our full cash value has decreased, yet the property taxes continue to rise.

https://www.facebook.com/groups/LaveenCommunity/posts/10161491904106831/